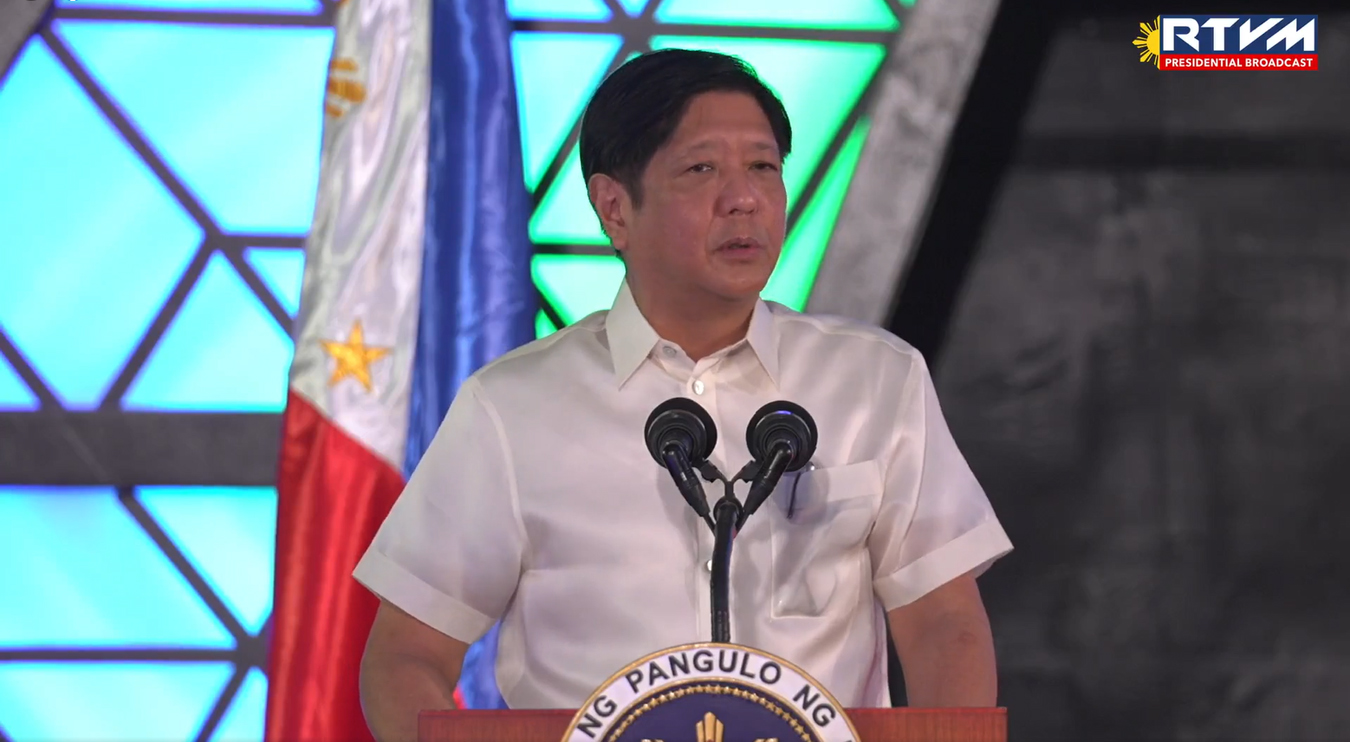

Thank you very much to the Finance Secretary Ben Diokno. [Oh, please be seated.]

The other members of the Cabinet who are here, up on stage is Secretary Benny of the DOLE; and of course our host for today’s festivities, Bureau of Internal Revenue Commissioner Jun Lumagui; Pasay City Mayor Imelda Calixto-Rubiano; my fellow workers in government; other distinguished guests and we have many of them. Talaga namang pagka BIR ang tumawag present lahat. Hindi lamang ‘yung mga malalaking negosyante, hindi lamang ‘yung ano — hanggang Presidente present. Dahil totoo naman the BIR provides the lifeblood of government. Ladies and gentlemen, magandang umaga po — ay magandang hapon po sa inyong lahat.

I am honored to speak before you today as we commence the Bureau of Internal Revenue’s plans and programs in 2023 with the BIR National Tax Campaign Kickoff.

We convey our earnest congratulations to the officials and employees of the BIR who have played key roles in the continued progress and development of the institution in 2022, despite facing the challenges of the pandemic throughout these last two and a half years.

The endeavors you have pursued not only speak for your zeal and vigor to deliver your mandate, but highlight as well the critical role that you have played in ensuring that the government’s programs and projects are wholly funded and implemented.

At this juncture, we acknowledge the BIR’s efforts in the country’s revenue collection for 2022.

You have intensified the implementation of the Run After Tax Evaders that delved into the violations of the Tax Code and to ensure that the tax evaders will pay their taxes due to the government.

In 2022, 115 cases were filed with the Department of Justice amounting to 5.1 billion pesos in tax liability, while 38 cases were filed with the Court of Tax Appeals amounting to an estimated 5.32 billion pesos in estimated tax liability.

Just recently, 74 criminal complaints for tax evasion were filed with the DOJ, with about 3.58 billion pesos in tax liability.

Through these efforts to strengthen the imposition of administrative sanctions with the Oplan Kandado program, you have brought more than 550 million pesos to the government coffers.

You have likewise broadened our Tax Base through the aggressive Tax Compliance Drive, which enabled the bureau to collect more than 250 million pesos in 2022, which was double of what it was in the previous year.

That growth represents a remarkable 13 percent higher than the BIR’s own target of 3 percent for the year and covered around 5.2 million business taxpayers.

Furthermore, you have now harnessed the power of modern technology to accomplish more efficient, effective, and reliable tax collections through the Digitalization Transformation or DX Program.

This includes the implementation of the Internal Revenue Integrated System; the one-time transaction or the eONETT system; the Interactive chatbot “Revie”; an automated system for Monitoring and Managing Administrative Cases; and an Enhanced Internal Revenue Stamps Integrated System for tobacco products, alcohol, and sweetened beverages.

Indeed, you have been firm and resolute in modernizing the services and elevating our people’s experiences by utilizing reliable, scalable, robust, sustainable technologies and infrastructure for our country’s tax collection.

As we move forward to the future, the importance of utilizing modern and updated technology to ensure a more tax [efficient] collection becomes absolutely imperative. It is my hope that the Bureau will continue its commitment to pursuing and upgrading its digitalization programs.

I also furthermore challenge the men and women of the BIR to work towards further gaining the confidence of the public in the tax system by upholding the highest standards of integrity, professionalism, and competence in the performance of your duties.

I assure the BIR that this administration will always give its support in your aspiration of developing a country that is conducive for employment opportunities, financial investments, and institution-building.

More importantly, I encourage the public to pay the correct amount of taxes on time to support the country’s economic recovery and expansion so critical in this time.

It is my confidence that you will continue to cooperate, collaborate, and coordinate with the government on how to improve the experience of our tax collection system.

I trust that our synergy will give rise to even more opportunities for growth, especially now that we are recovering from the adverse impacts of the global health crisis over the years.

But rest assured that this government will remain committed to managing and utilizing these contributions for the benefit of the country and for every Filipino. And also we will ensure that every peso of taxes paid will become an investment in uplifting the quality of lives of every Juan and Juana.

Together, let us join hands in building a more equitable, progressive, and prosperous society where every Filipino has the chance to improve their lives, pursue their aspirations, and contribute to the building of our nation.

Once again, congratulations to the Bureau of Internal Revenue for this – the drive and the passion and the commitment that you have shown to improving the services of the BIR to our people, and to give this government the largest possible range of options as we face the challenges of the new global economy.

Maraming, maraming salamat po sa inyong lahat. Congratulations muli at magandang hapon po sa inyong lahat. [applause]

— END —

Watch here: 2023 National Tax Campaign Kick-Off

Location: Philippine International Convention Center in Pasay City